|

Garry Heath Garry Heath

Member of the FECIF board / Director General Libertatem UK

Major insights into the impact of regulation

Every two years, the UK’s adviser trade association, The Impartial Financial Advisers Association, creates a report on the availability of professional advice to UK consumers. This report is created from desktop research via already published information combined with a major survey into the attitude of adviser firms.

As the UK probably has the most invasive type of regulation, this report is received not only in the UK but across the world. The concept was created in 2015 after the UK regulator decided to arbitrarily change the advice market. These changes destroyed advice access to over 12m modestly-paid consumers.

The Heath Report Four survey (THR4) has doubled its respondents between THR2 and THR4. This year we had full responses from 295 firms representing 1,319 advisers. Only 5% of respondents described their firms as focussing on mortgages and/or protection.

The Heath Report Four will be launched later this month but we have some of the early results.

The prime headline issue is how many UK consumers are using the professional advice sector. One might guess that the numbers would drop due to COVID and losing 950 advisers in the period, but bizarrely, sector capacity has increased by 1.2m new clients, to 6.1m.

This is really good news. The more consumers we handle - the more important advisers are to the UK Finance Ministry and to politicians.

In 2005, our sector used to service 16m consumers but by the Heath Report 3, at the end of 2019, we were servicing less than 5m. How did this happen?

- Some of it may be an understanding that the use of Zoom and Teams makes advisers far more productive and therefore able to service a greater number of clients.

- It may be that the lockdown gave prospective clients more time to contemplate their futures and the advice they need.

- It may also be a realisation that, with adviser firm costs ever increasing, advisers need to widen their client banks simply to maintain profitability.

- Or possibly a combination of these factors.

The next important line of research is what is the effect of business types on the provision of advice.

One of the regular questions asked by all the Heath Reports is based on the type of advice firm answering the questions.

We established four potential types:

Boutique: My firm only takes on a limited number of clients from a clearly defined target market, and for whom our service is specifically designed.

Segmented: My firm pro-actively seeks as clients, people from one or more specific target markets, but will accommodate other types of clients.

Generalist: My firm provides financial advice to a wide range of potential customers and is continuously trying to engage with new clients

Other: None of the above

On THR1 in 2015 each of the 3 types recorded 30%, with “Other” making 10%. At that time the market expectation was that “Boutique” and “Segmented” would benefit from the change and “Generalist” firms were expected to fail.

7 years later we have seen the reverse of that expectation. “Boutique” firms peaked in 2019 but are now in retreat. “Segmented” dropped by half in 2019 and is now showing a small improvement. “Generalist” firms have held ground and are now showing an improved market share.

They are also the quickest to recruit new advisers, the most profitable, and an increasing power in the market.

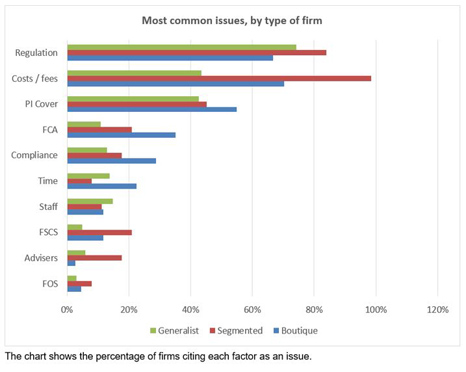

Advisers’ Most Common Issues

We next looked at what are the key issues for adviser firms.

The first 5 issues are fully regulation-related with many types of business indicating a rate of 75%.

The normal business-related issues rarely feature higher than 20%.

Adviser Representation

You might think that if the top five issues are based on regulation, adviser firms would be very keen to be represented properly.

Sadly not. Currently, 87% of UK advisers are willing to consider a new professional body with only 13% wishing to stay with their current body.

Trade Associations show little better. Whilst IFAA is 4 times more popular than its opposition, the most popular trade body is doing nothing. So, whilst adviser firms are most worried about the subjects that trade associations can improve, less than 20% of all firms are willing to pay for the representation.

|